Throughout 2015 GSU was engaged in a close process with Bangladesh Bank, the national bank of Bangladesh, on the matter of evaluating the opportunity of adapting the GSU’s national weighted equilibrium exchange rate system for potential use there.

Analysis

|

The analysis made showed that by adopting the solution developed by GSU, Bangladesh could move to a market-based system which would reduce the exchange-rate fluctuations for the entire country by 40% compared to the rigid peg to the US dollar used today. That means a reduced risk and cost of 40% for all international transactions in and out of Bangladesh.

Besides that directly reduced risk and cost (amounting to hundreds of millions USD for the trading companies), the solution would also contribute to overall improved competitiveness internationally and improve stability domestically.

|

|

|

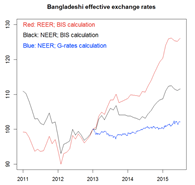

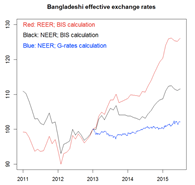

NEER REER

|

|

To further establish documentation of the advantages of implementing the solution developed by GCU, an advanced analysis of nominal and real effective exchange rates (NEER REER) for Bangladesh was made using the same methodology for such analysis as that used by the Bank for International Settlements.

|

The result underlined the significantly improved stability the solution from GSU would contribute.

During the process, the GSU also consulted the major industry organizations in Bangladesh, all of which expressed an interest in implementing the new solution.